Bond ladder calculator

28 and 5-Year Government Bond est. Our bond repayment calculator helps you plan and budget.

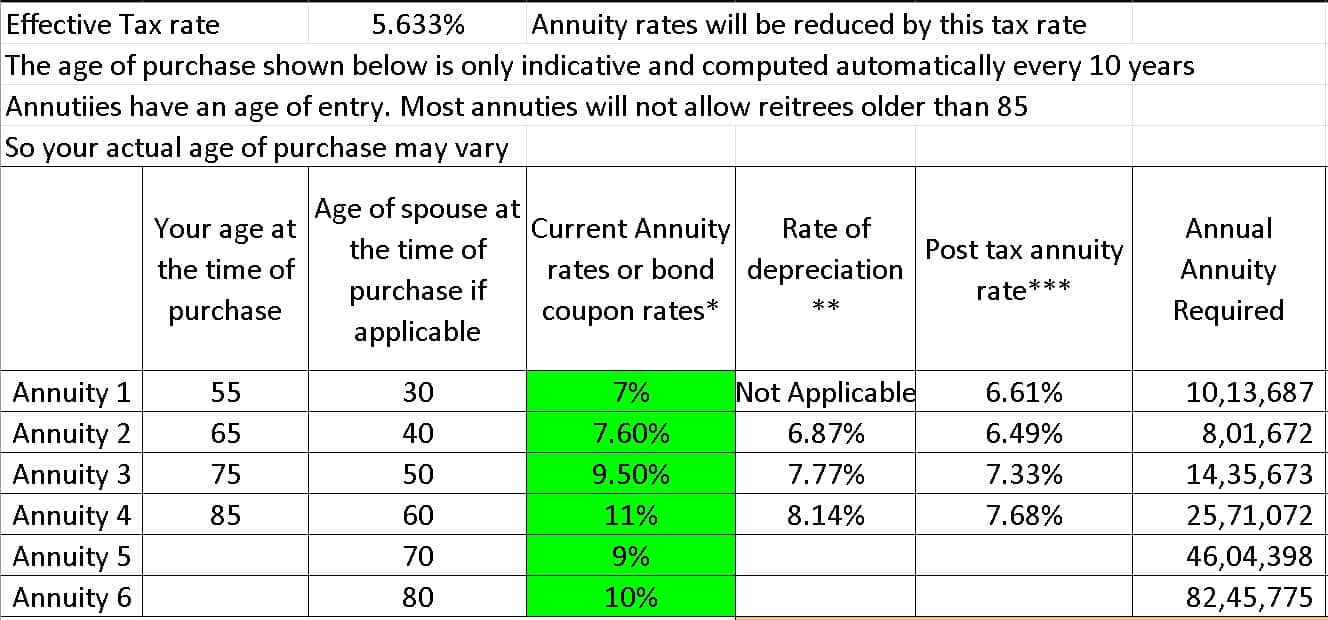

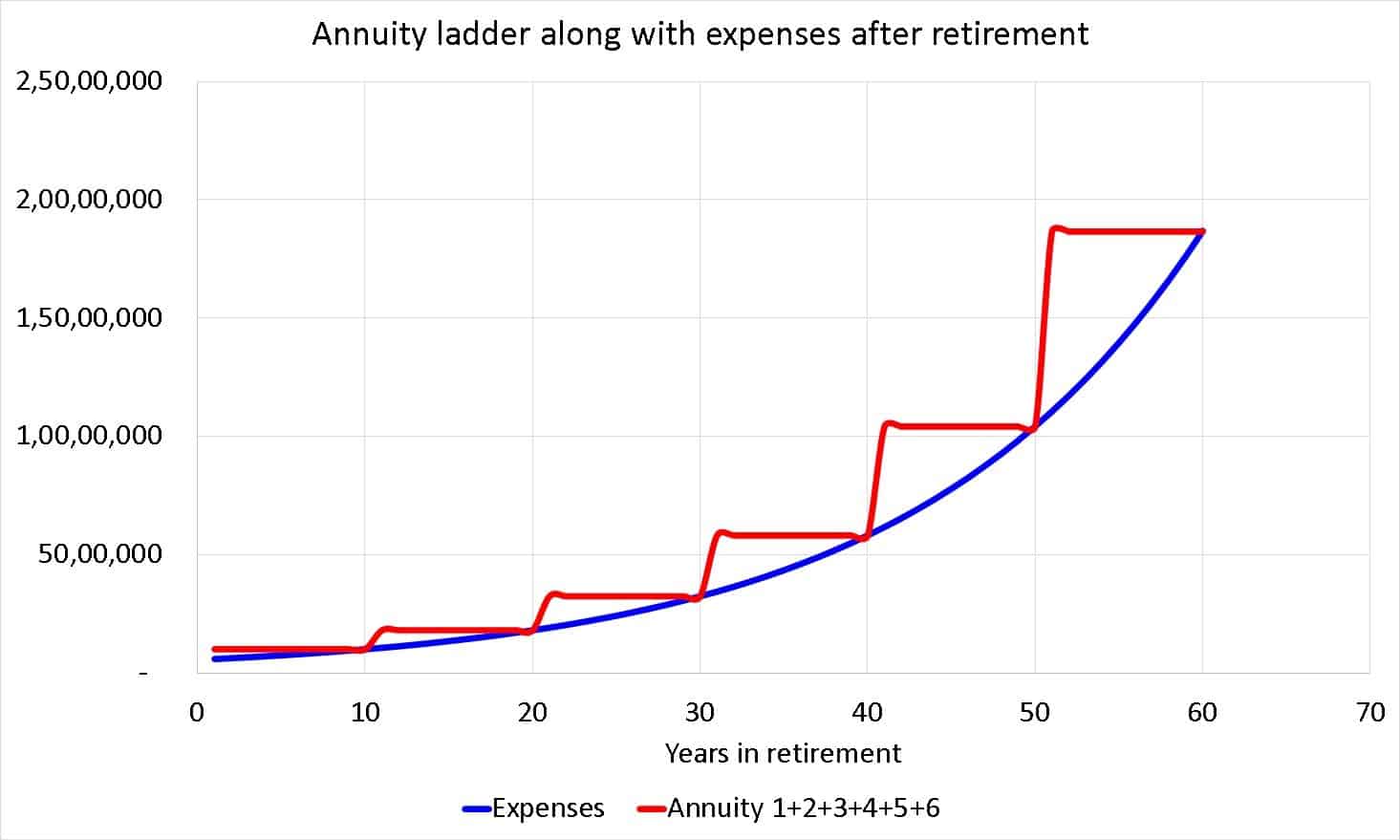

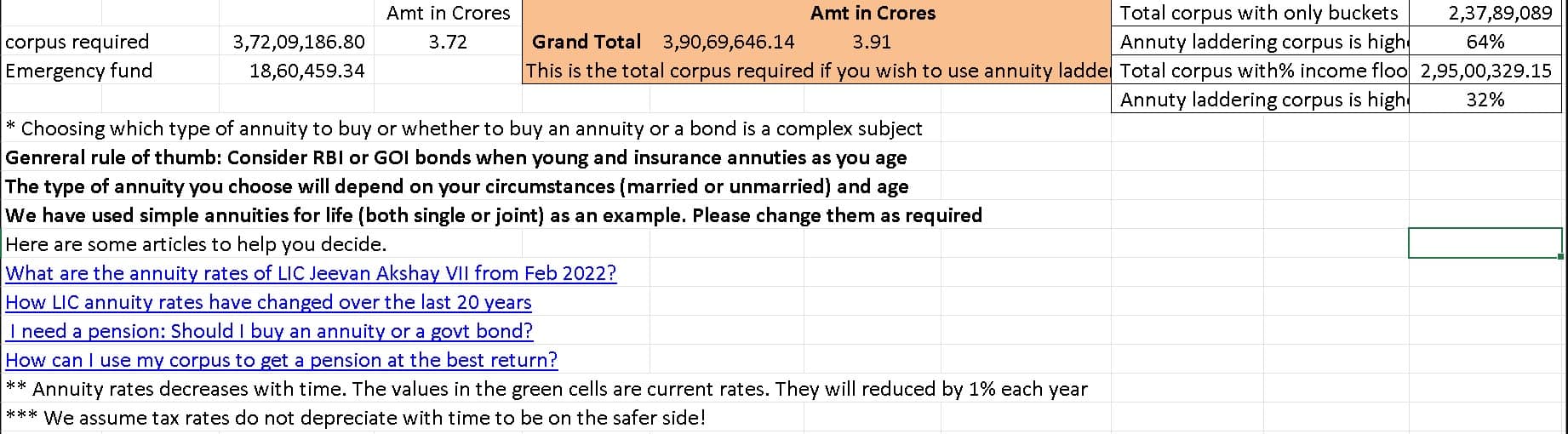

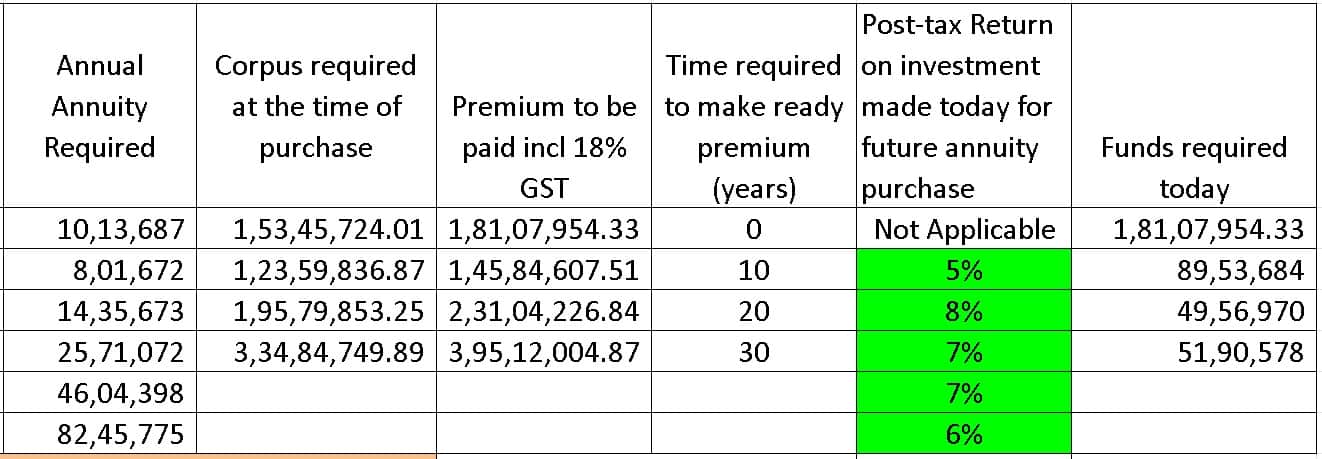

Use This Annuity Ladder Calculator To Plan For Retirement

275 Issue on 1st September 2022.

. A good suggestion may be to form some sort of treasury bill ladder. How much do I need to make for a 900000 house. 10-year Treasury yields may have peaked in June Source.

Explore personal finance topics including credit cards investments identity. Reduced bond value. This strategy is designed to provide current income while minimizing exposure to interest rate fluctuations.

Each rung of the ladder represents a bond. Daily data as of 6302022. A bond ladder strategy can be an effective way to average into the market.

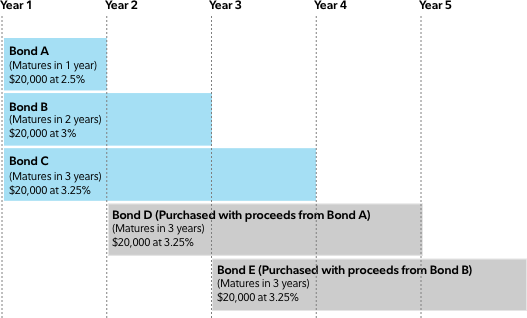

A bond ladder is a portfolio of individual bonds that mature at different rates. It uses the purchase price of the property and the current interest rate to tell your home loan amount and monthly repayment. The Standard Poors 500 SP 500 for the 10 years ending December 31 st 2018 had an annual compounded rate of return of 121 including reinvestment.

A 900000 home with a 5 interest rate for 30 years and 45000 5 down requires an annual income of 218403. While that may sound complicated in practice it is much easier than it seems. Generic 10-year Treasury Yield USGG10YR INDEX.

By contrast if you purchase a 1000 bond with an interest rate of 5 percent and rates fall to 4 percent your bond will increase in value until they can be purchased at a price that will result in an interest rate that approaches 4 percent. If theyre lower the ladder still includes. This calculator assumes that your return is compounded annually and your deposits are made monthly.

Similar in function to a CD a savings bond lets you earn interest on an upfront sum of money that you cant access for a period. The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually. This lets us find the most appropriate writer for any type of assignment.

Purchase your selected bonds and CDs even your complete bond ladder online in one easy step. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. This lets us find the most appropriate writer for any type of assignment.

The other issue is a longer tenor government bond issue. A CD ladder is a savings strategy with staggered maturity dates that allows savers to take advantage of higher rates without tying up all their money. Bankrate compares thousands of financial institutions to make it easy for you to apply for the best certificate of deposit rate.

A bond ladder can help investors earn a steady stream of income from their security holdings while increasing the potential for greater returns should interest rates rise in the future. Finance Math Health Fitness and more calculators all brought to you for free. Instead of lending money to a bank as you do with.

As each bond matures you can reinvest the principal at current interest rates. The calculator will then reply with an income value with which you compare your current income. 833 x 6 percent market rate 4998.

Adjunct membership is for researchers employed by other institutions who collaborate with IDM Members to the extent that some of their own staff andor postgraduate students may work within the IDM. If interest rates are higher you gain the advantage of better yields. When the first bond matures in 2 years you reinvest the money in a bond with a 10-year maturity maintaining the ladder youve constructed.

A bond ladder is a classic passive investment that has appealed to retirees and near-retirees for. The issuer credit quality is excellent but. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

Retirement plan income calculator. Updated Study Notes and Revision Kits MASOMO MSINGI PUBLISHERS. Find the best CD rates by comparing national and local rates.

The actual rate of return is largely dependent on the types of investments you select. Instead of buying bonds that are scheduled to mature during the same year you purchase CDs or bonds that mature at staggered future dates. Rental price 70 per night.

A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages. Build your own bond ladder using powerful portfolio analysis tools evaluating average price yield coupon rate and cash flow. Our real estate blogs cover all topics related to residential real estate investing such as locating the best places to invest in real estate conducting investment property search performing rental property analysis finding top-performing investment properties choosing the optimal rental strategy traditional or Airbnb and others.

New 6-Month Bill est. College Savings Calculator 529 Savings Plan Overview 529 State Tax Calculator Learning Quest 529 Plan. A bond ladder is a portfolio of individual CDs or bonds that mature on different dates.

GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path. Conveniently view open orders for fixed-income investments along with those for equity products on the TD Ameritrade home. The 12-wave 80-meter doublet with ladder line all the way to a 11 bifilar chokebalun in or near the tuner is a much better antenna for 80-10 provided you adjust the ladder line length to avoid the voltage and current anti-nodes ie extreme low or high impedances at the tuner end on all bands.

Free and easy to use calculators for all of your daily problems. For 3-year terms which are renewable. It works on a standard repayment term of 20 years and also tells you the total amount repayable over the term of your loan.

Say your ladder has bonds that mature in 2 4 6 8 and 10 years. With this simple bond ladder you would have 5000 to reinvest each year.

Climbing The Wealth Ladder Wealth Freedom Travel Data

Laddered Investing Interest Rate Scenario Tool Eaton Vance

Individual Savings Bond Calculator Inventory Instructions

Use This Annuity Ladder Calculator To Plan For Retirement

Municipal Bond Ladder Calculator Tools Nuveen

Bond Ladder Illustrator J P Morgan Asset Management

Rich Broke Or Dead Post Retirement Fire Calculator Visualizing Early Retirement Success And Longevity Risk Engaging Data

Bond Yield Formula And Calculator Excel Template

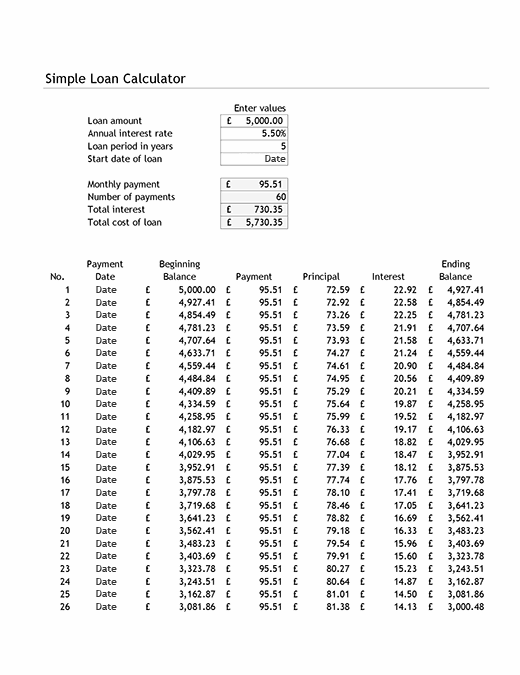

Simple Loan Calculator And Amortisation Table

Bond Ladder Tool From Fidelity

Bail Bond Calculator Instructions On How It Works Bail Bondsman Bail Instruction

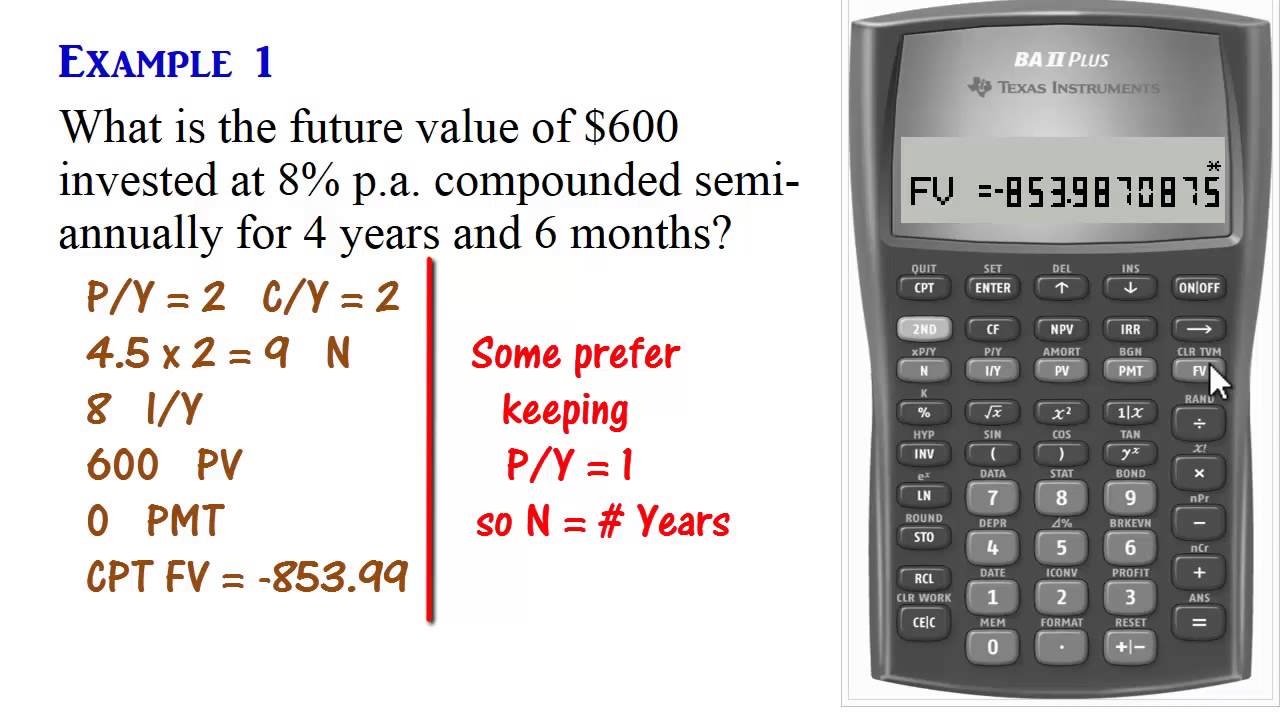

Ba Ii Plus Calculator Compound Interest Present Future Values Youtube

Use This Annuity Ladder Calculator To Plan For Retirement

Bond Yield Formula And Calculator Excel Template

Classic Core 4 Portfolio Core 4 Portfolio Meaning Corporate Bonds Commercial Real Estate Marketing

Pay Off Mortgage Vs Invest Calculator

Use This Annuity Ladder Calculator To Plan For Retirement